Soros Fund Management Interview

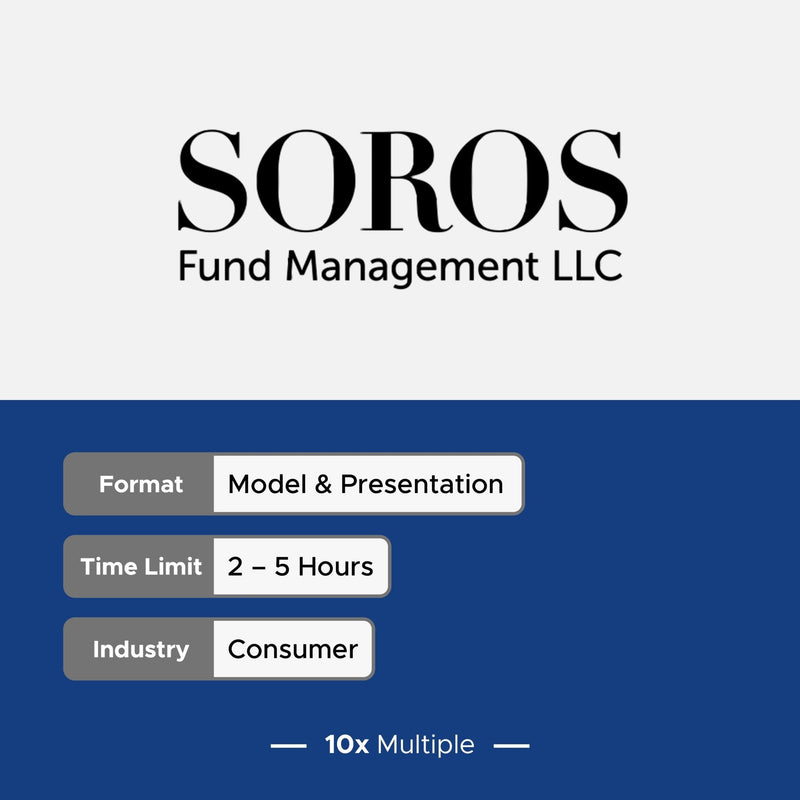

This interview conducted by Soros Capital Management (Quantum Strategic Partners) asks the candidate to consider the take-private of a clothing merchandiser. In addition to the interview prompt, the candidate is provided with the asset’s annual report.

The candidate is expected to prepare two outputs:

- 1) An LBO model based on transaction assumptions outlined in the interview prompt

- 2) Answers to a set of questions which include a perspective on the asset, the asset’s return profile, and key drivers & risks associated with the assets different business segments

Following completion of these outputs, the candidate is expected to present their findings and participate in a Q&A session.

- Regular price

- $24.99

- Sale price

- $24.99

- Regular price

-

- Unit price

- / per

Our Users Have Landed Offers With Top Funds

"I landed a dream seat during this years on-cycle process and much of that is because of this site. The models and case studies were spot-on compared to what I actually got during interviews"

"Just wanted to send over my appreciation for the 10xMultiple site and all your help over email these last couple months. I landed a spot with Apollo this cycle after my interviews last night!"

"This is a fantastic resource for anyone serious about breaking into PE. Once I knew the basics, I pretty much just drilled cases from this site"

Frequently Asked Questions

Yes – Every interview on 10xMultiple.com is a real interview conducted by the firm it is attributed to

All interviews on 10xMultiple.com are digital products (i.e., no physical copy of the interview material will be shipped to you)

- After checkout, you will receive a link to download the files associated with each interview

- The files included with each interview are outlined in the description and product pictures

These materials are the exact same materials that Soros Fund Management provided to the candidate who was given this interview to provide you with the most realistic experience