Free Mega-Fund Case Study Interview

This free case study interview was conducted by an unnamed Mega-Fund as part of its on-cycle recruiting process. The assessment asks the candidate to evaluate a potential buyout of an asset in the educational software market.

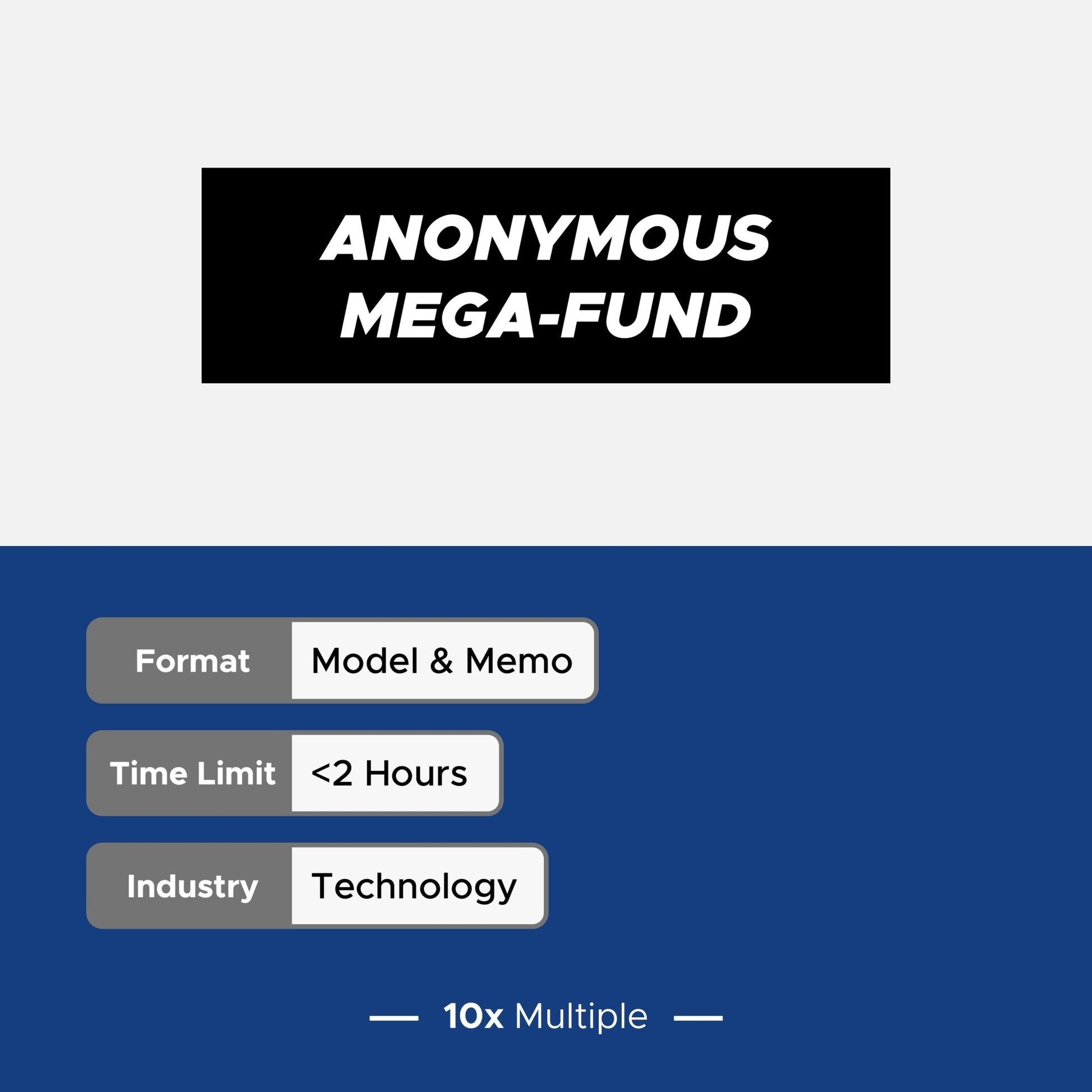

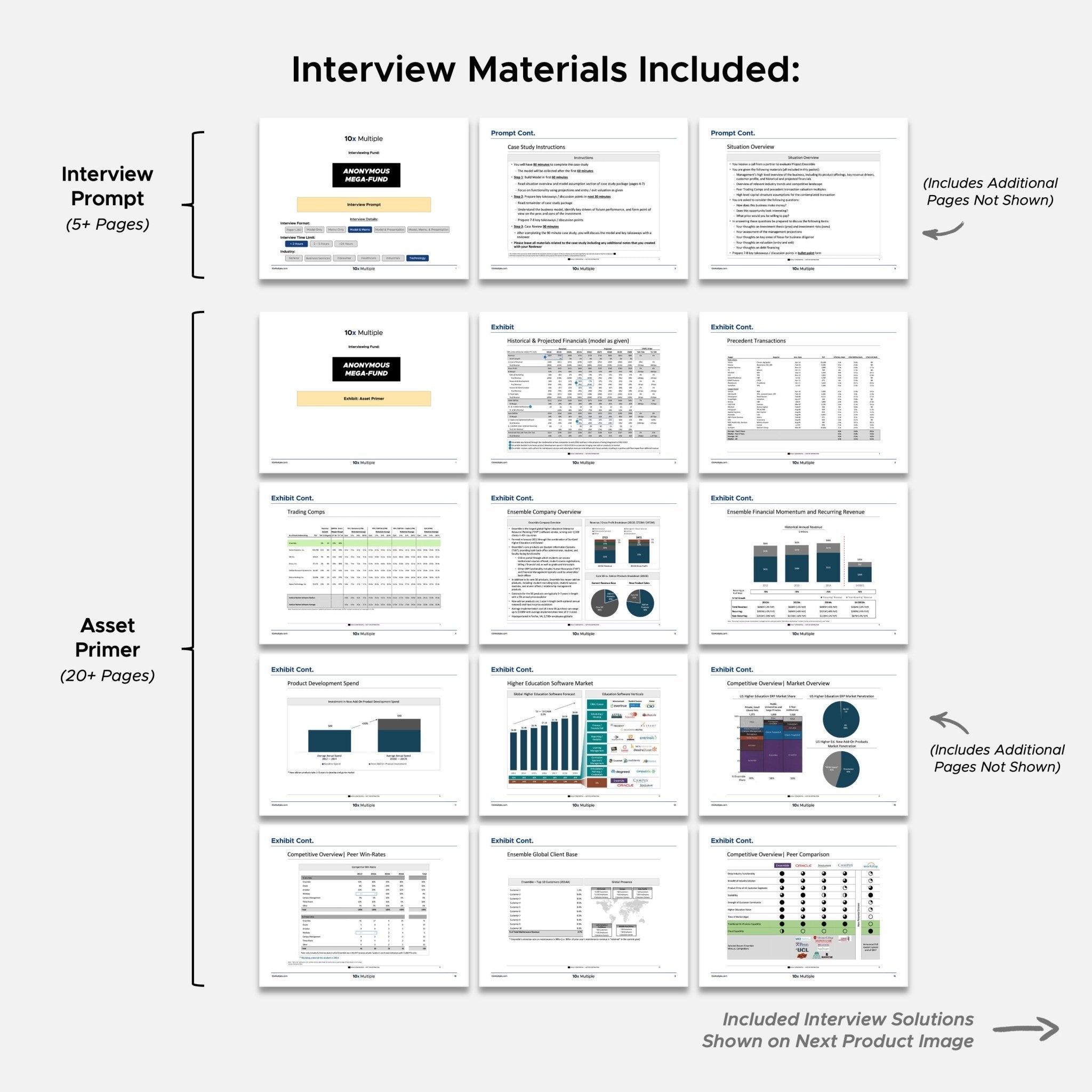

The candidate is provided with two documents:

- 1) An interview prompt which outlines the case study instructions and provides relevant transaction assumptions

- 2) An asset primer, which provides an overview of the assets business model, financials, and relevant market dynamics

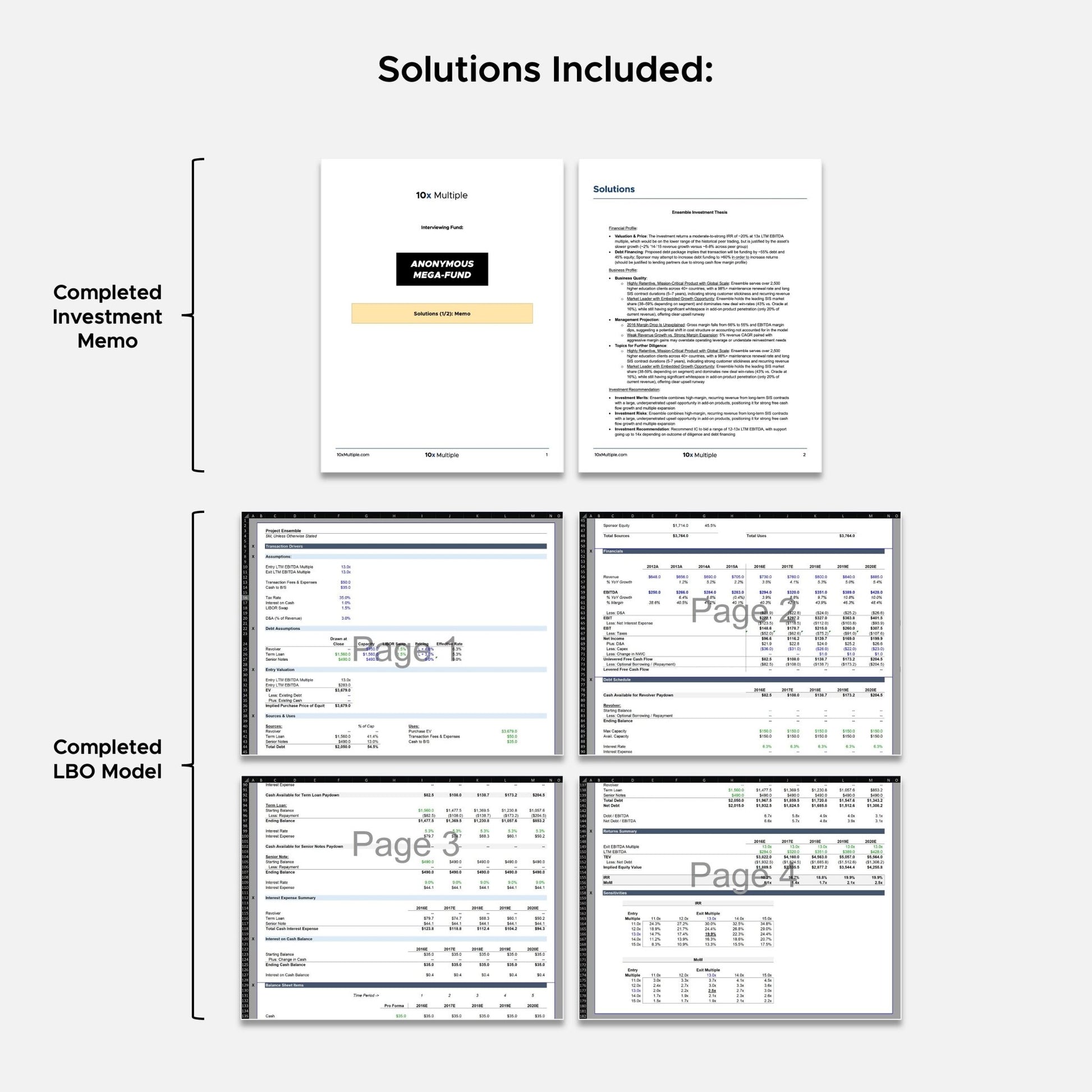

The candidate is given 90 minutes to prepare two outputs:

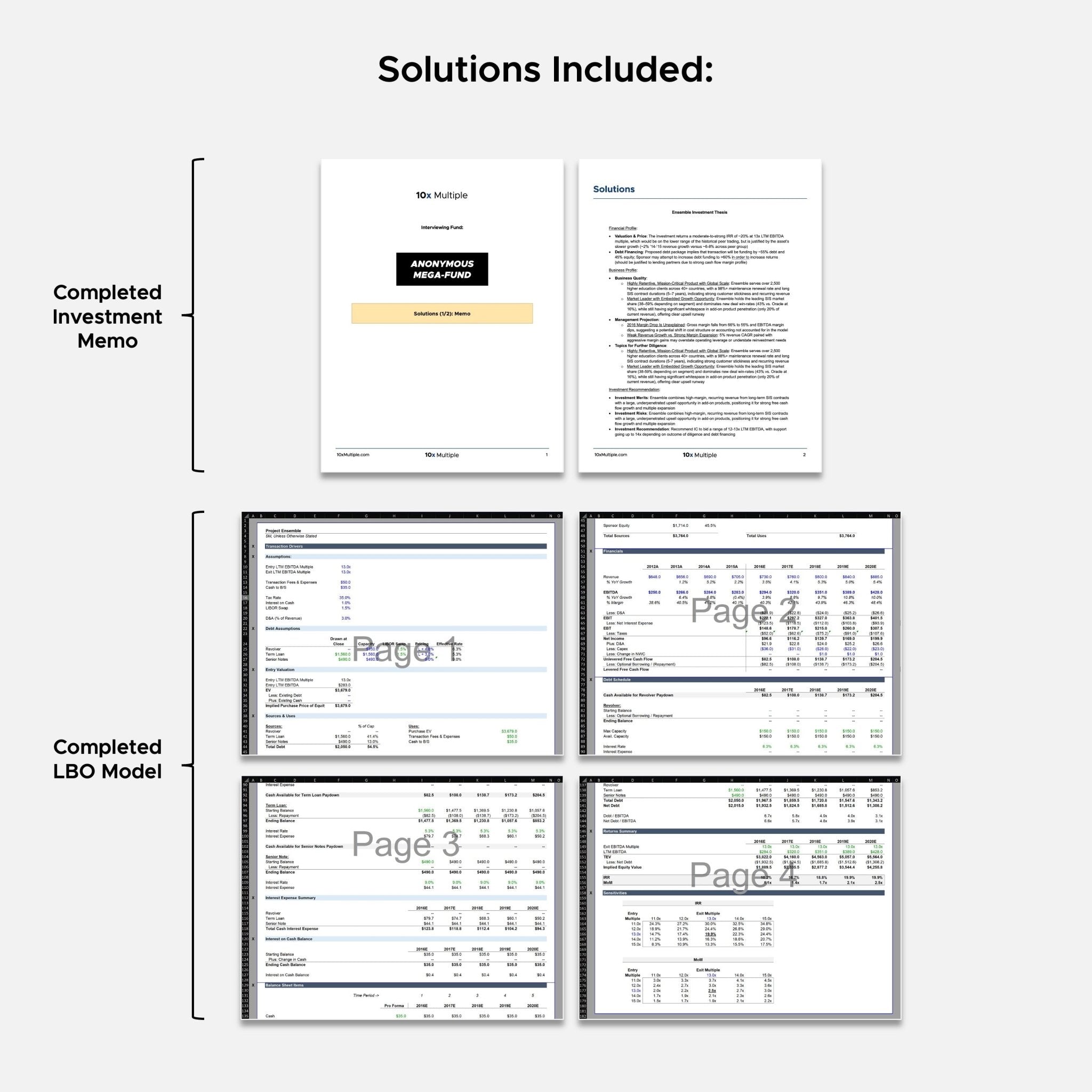

- 1) A completed LBO model which includes sources & uses, income statement, build to levered FCF, debt schedule, equity returns, and relevant sensitivities and

- 2) An investment memo which outlines the candidates view on the assets business model, merits and risks of the investment, and ultimate investment recommendation

Following completion of these outputs, the candidate is expected to present their findings and participate in a Q&A session. This interview includes solutions.

- Regular price

- $0.00

- Sale price

- $0.00

- Regular price

-

- Unit price

- / per

Our Users Have Landed Offers With Top Funds

"I landed a dream seat during this years on-cycle process and much of that is because of this site. The models and case studies were spot-on compared to what I actually got during interviews"

"Just wanted to send over my appreciation for the 10xMultiple site and all your help over email these last couple months. I landed a spot with Apollo this cycle after my interviews last night!"

"This is a fantastic resource for anyone serious about breaking into PE. Once I knew the basics, I pretty much just drilled cases from this site"